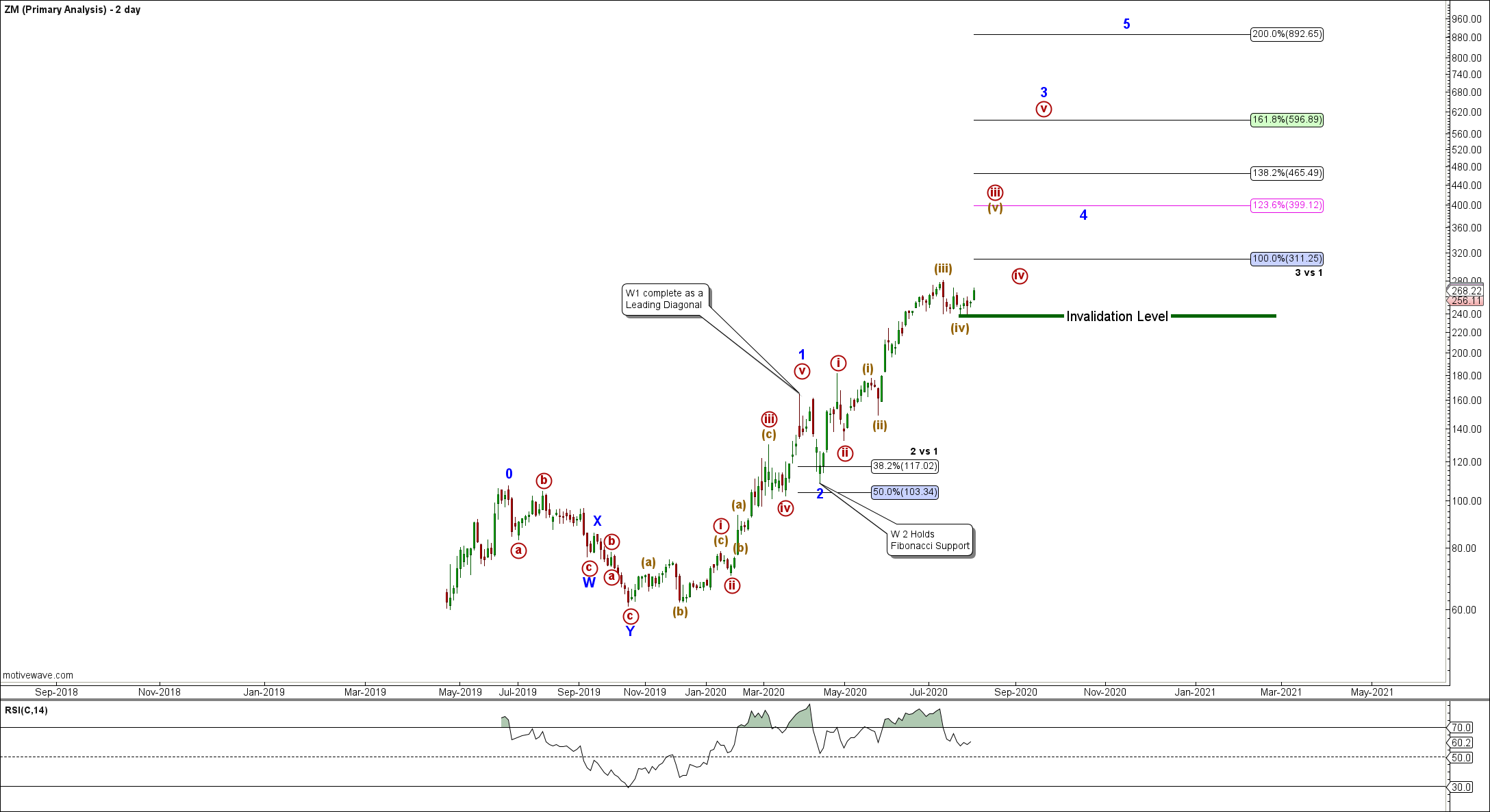

Zoom Video Communications Inc (ZM) looks interesting to the long side again here. We first notified subscribers of the potential upside in this stock on 6th December 2019 when we took a long position at $62.02. Zoom was displaying the potential for the start of an impulse wave to the upside after a common pattern following its IPO appeared to have made a significant bottom and initial basing pattern with positively diverged RSI and a classic Daily Squeeze building that preceded a system BUY Signal.

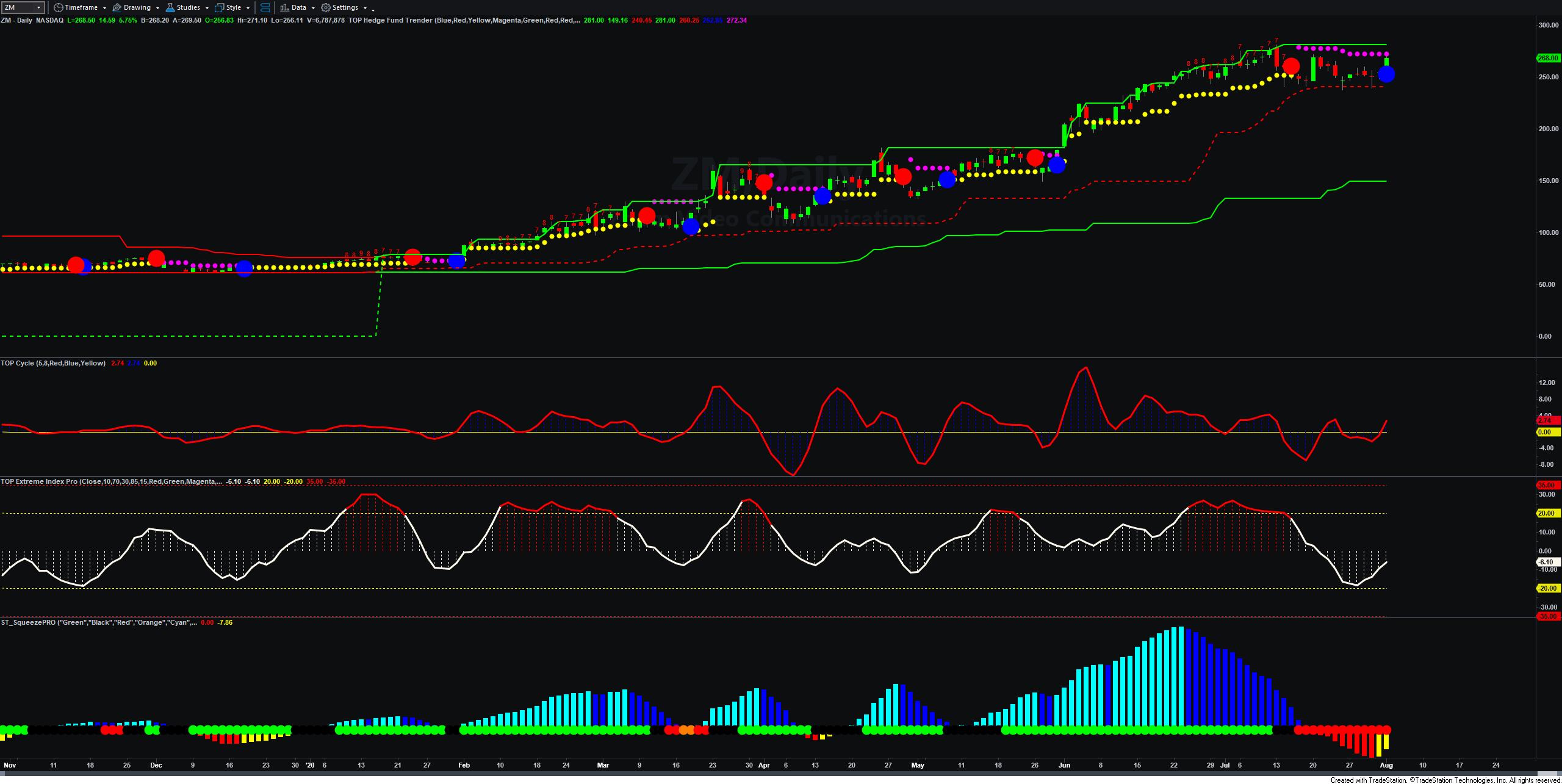

From the Wave 2 low which held expected Fibonacci support in early April 2020, ZM looks to be in the heart of the Wave 3 up. We have seen a high level consolidation since Mid July with a Daily Squeeze building, momentum indicators starting to move up and with yesterdays push higher we had both an intraday 240 Minute BUY Signal followed by a Daily BUY Signal at yesterdays close. The Daily Cycle also appears to have bottomed on 30th July and is now suggesting a more to the upside.

Zoom is scheduled to report quarterly earnings after the Market Close on 31st August 2020. Projected growth is impressive and comes on the back of first quarter profits that were up 566%. Short interest currently stands at 6.4% representing 2 1/4 days to cover which supports the potential expectation of a push higher from here into the end of the month. Looking at the Daily Chart the next potential target is the 123.6% Fibonacci Extension at $399.12 provided $311.25 is cleared. Looking for ZM to now remain above 236.00 and ideally $248.00 from here and both the 240 Minute & Daily Squeezes that have been developing since Mid July to fire to the Long Side. (See Video Analysis Here: >> Watch Now