US Markets have been on a tear to the upside since the dramatic drop into the lows seen earlier this year. The technology heavy Nasdaq has exceeded its all time high from February 2020, The S&P 500 is now approaching that same high while the Dow Jones Industrial Average & Russell 2000 Small Cap Index are lagging slightly behind. With the world seemingly in turmoil & in the grip of the Covid 19 Pandemic, Central Bankers printing money and throwing it around like confetti, unemployment rising and the leaders of Nations providing little more than a tragic puppet show this all seems counter intuitive.

We have Non Farm Payrolls being announced before the opening bell in the US tomorrow (Friday 7th August) which often marks the commencement of a directional move in the markets so let’s take a look at where we are and what to look for over the coming weeks in the benchmark US Index Futures.

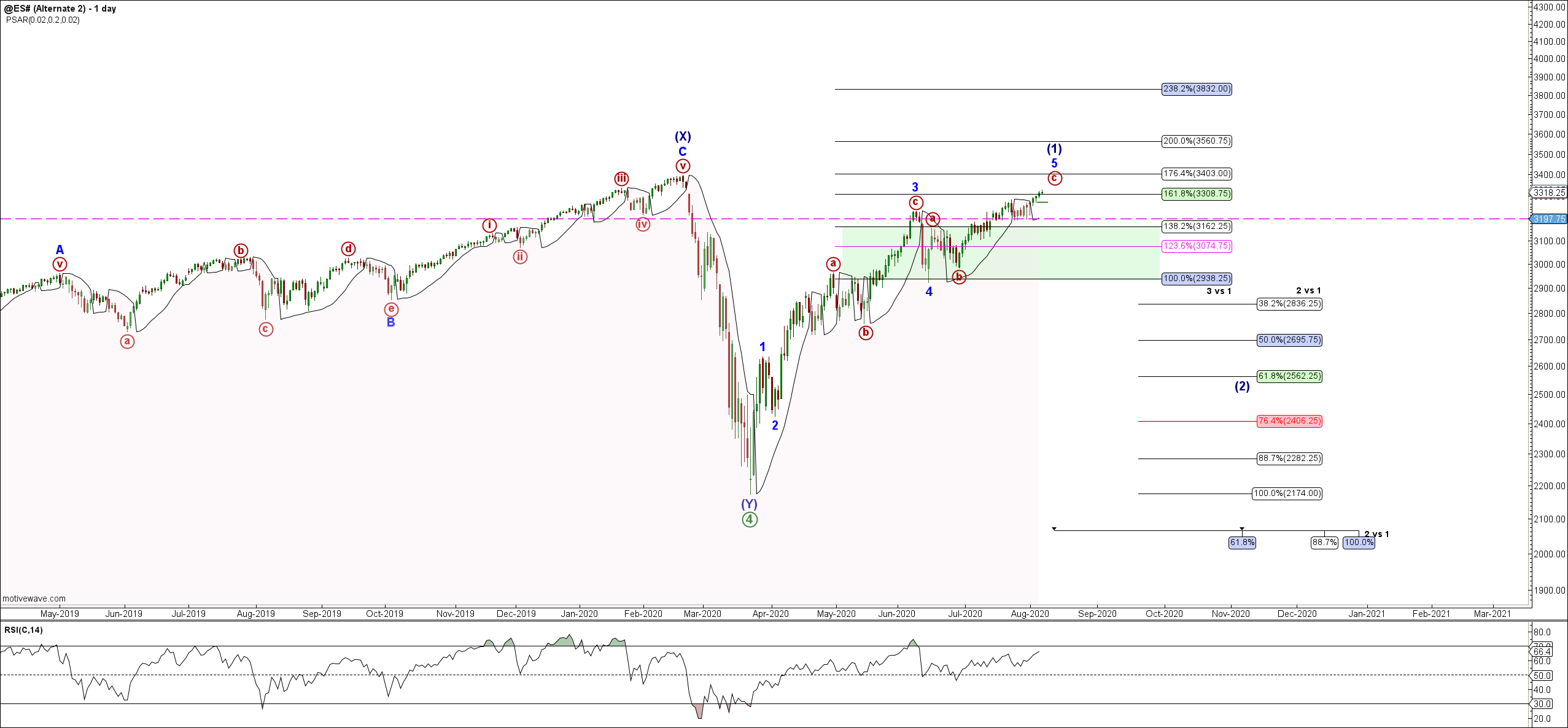

The ES looks to have completed a complex Primary Degree Wave 4 at the low seen in March 2020. The drop into that low was the fastest recorded drop of this magnitude off the February 2020 high. The key question now is wether all of the Primary Degree Wave 4 has completed at the March 2020 low and we are therefore in a Leading Diagonal to the upside for the Intermediate Degree Wave (1) of Primary Degree Wave 5 OR are we seeing a complex Intermediate Degree Wave (B) unfold with an Intermediate Degree Wave (C) down to new local lows to complete the Primary Degree Wave 4 still to come?

In analysing the SPX/ES I am working on the basis that the Primary Degree Wave 4 was in at the March 2020 low. The move up from there counts best in threes so a diagonal formation. Should we see the ES follow the NDX/NQ and exceed the February 2020 high then that opens up the possibility that this fractal is in fact an ending rather than leading diagonal either as the final Intermediate Degree Wave (5) of the Primary Degree Wave 3 off the March 2009 lows OR in fact as all of the Primary Degree Wave 5 off that low. Again, for the purpose of analysis I am currently running with thesis that this is a leading diagonal for the Intermediate Degree wave (1) of a much larger Primary Degree Wave 5 off the March 2020 low and that after a pullback in what would then be an Intermediate Degree Wave (2) we will see the US Indices subdivide much higher over the coming few years before a considerably deeper move to the downside is upon us.

Currently, the main US Indices look extended and there are numerous technical and other indicators suggesting that we may see the anticipated pullback sooner rather than later. I am watching 3342 – 3373 with a possibility of seeing 3403 in the ES Mini as likely levels from which that pullback may commence.

In the video (link below) I take an in depth look at the ES Mini and NQ and consider what we might see from here. >> Watch Now