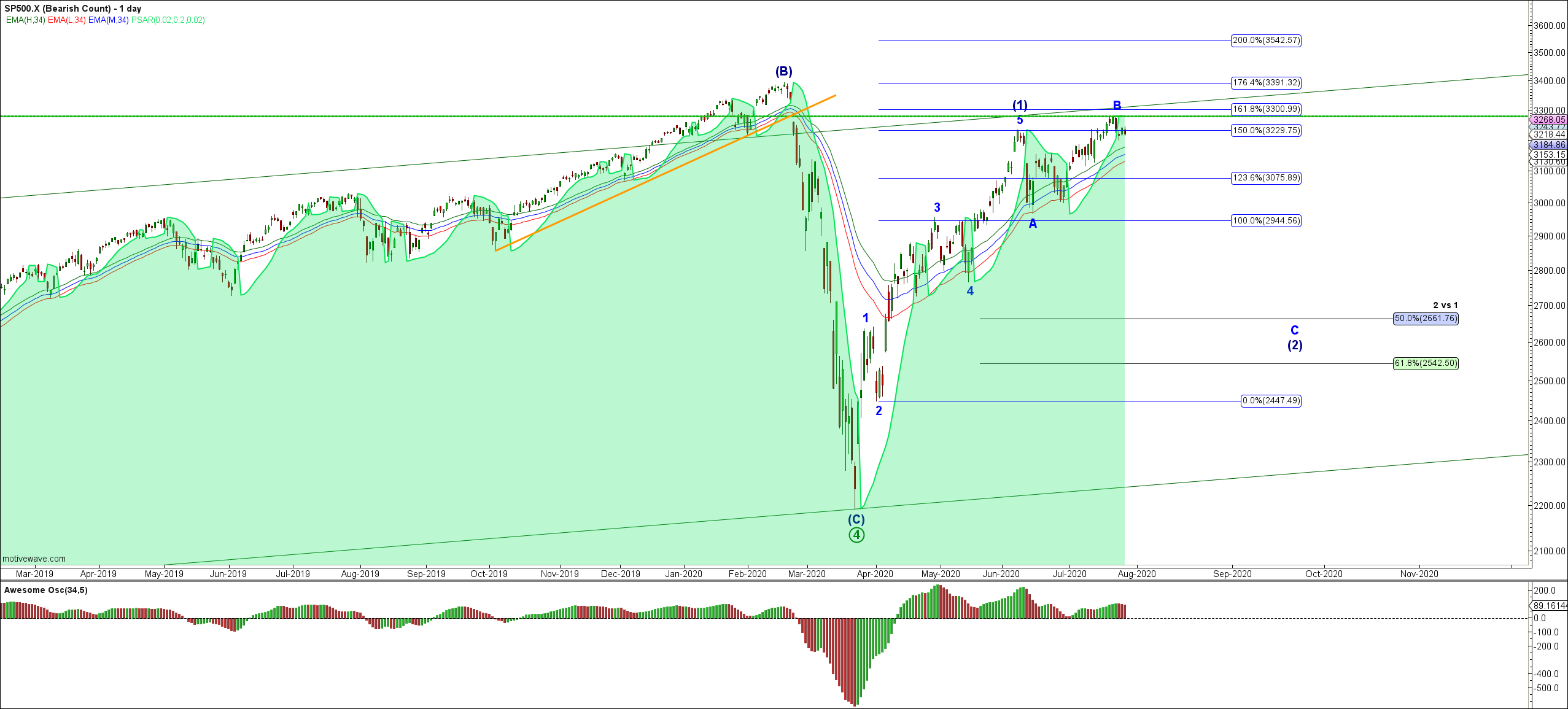

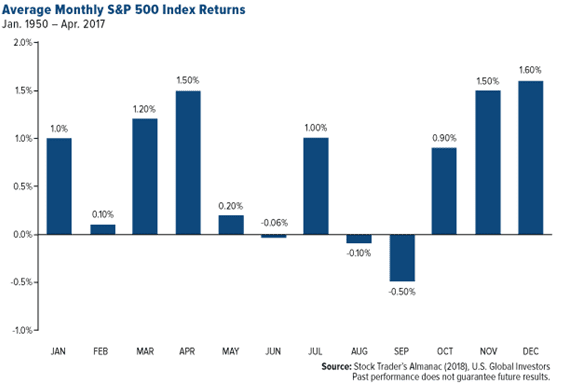

With the Main US Indices have been effectively range bound since early to mid June we are looking for the next significant directional move. Seasonally August has historically seen pullbacks in the S&P500 (See Chart). Will this unusually volatile year prove to be different?

There are a good number of potential catalysts over coming days. We have the FOMC minutes later today, CEO’s of Amazon, Apple, Facebook & Alphabet testifying before the House Antitrust Committee at 12.00 EST, ADP Unemployment & GDP figures being released Pre Market on Thursday followed by key earnings reports from AAPL, AMZN, GOOG & GOOGL after the bell.

While the liquidity landscape currently remains bullish there are also warnings. The FED continues to to print & pump at a rate well in excess of even the original QE back in 2009 but considerably less than the extreme levels seen in March & April. In essence they are providing enough to cover all of the Treasury Debt Issuance thus maintaining the status quo for now. With Congress & The Trump Circus looking to agree a renewed pandemic relief package with a rumoured cost of $1 Trillion the question will be how this then gets funded. The unknown factor here is the potential uses of the US Treasuries enormous cash reserves, currently around $1.8 Trillion. This has arisen from huge debt issuance over recent months that has as yet remained un spent. To fund further relief measures either this will be utilised or we will see a substantive increase in Treasury borrowing thus increasing the pressure on the printing machines.

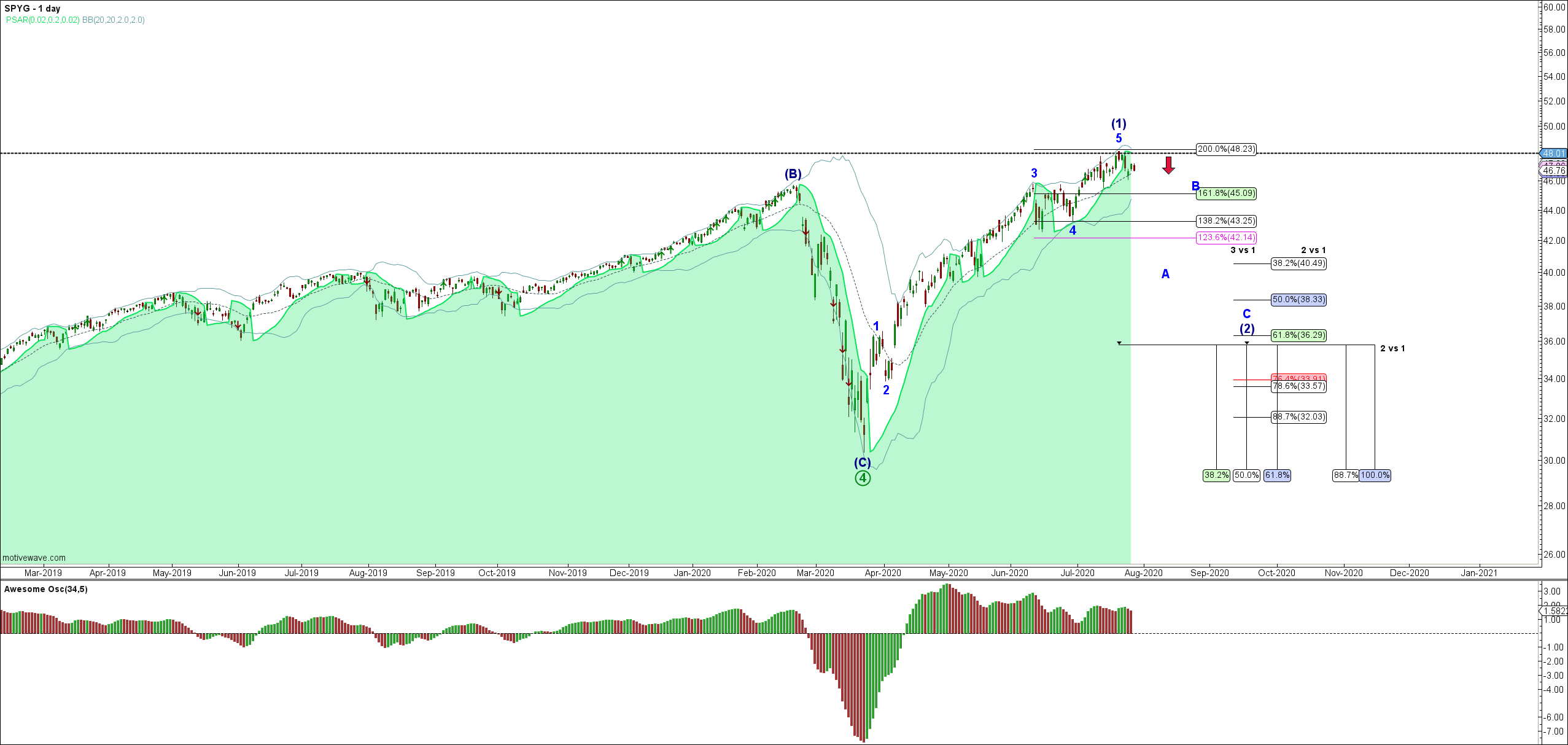

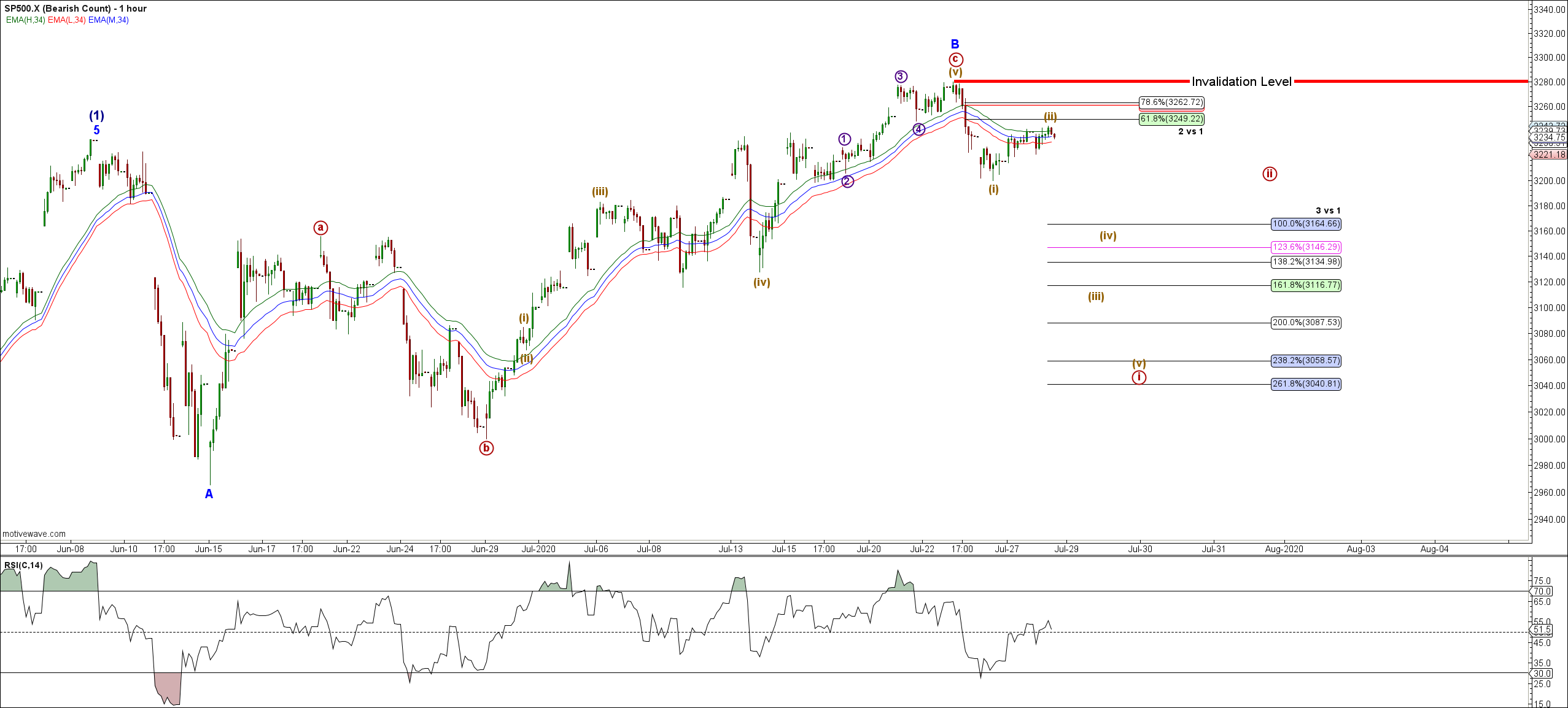

There are some cracks that have started to surface in the Bulls case. The key FAANG Stocks have started to pullback from recent highs and have what count as completed Five Wave Elliott Wave patterns up from the Mid March swing lows. Microsoft is down despite stellar earnings and forward guidance last week. The Indices look extended with Technical Indicators showing negative divergences, the PUT/CALL ratio at extreme levels from where sharp moves lower are usually seen and breadth is beginning to deteriorate, yet each pullback thus far has held above key support levels. Should we see the SPX trade back above 3263 then follow through above the most recent high at 3280 the next levels above are 3391 then 3542. A breakdown below 3000 suggest a target area below at 2662 – 2786 next.